European

Commission

European

Commission

Guide to Cost-Benefit Analysis of Investment Projects

Economic appraisal tool for Cohesion Policy 2014-2020

December 2014

Regional and Urban Policy

^ -”jr

Europe Direct is a service to help you find answers to your questions about the European Union.

Freephone number (*):

(*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you).

EUROPEAN COMMISSION

Directorate-General for Regional and Urban policy

REGIO DG 02 - Communication

Mrs Ana-Paula Laissy

Avenue de Beaulieu 1

1160 Brussels

BELGIUM

E-mail: regio-publication@ec.europa.eu

Internet: http://ec.europa.eu/regional_policy/index_en.cfm

More information on the European Union is available on the Internet (http://europa.eu). Luxembourg: Publications Office of the European Union, 2015

ISBN 978-92-79-34796-2 doi:10.2776/97516

© European Union, 2015

Reproduction is authorised provided the source is acknowledged.

Printed in Italy

PRiNTED on ELEMENTAL CHLORiNE-FREE BLEACHED paper (ECF)

Economic appraisal tool for Cohesion Policy 2014-2020

European Commission

Directorate-General for Regional and Urban policy

Authors: Davide Sartori (Centre for Industrial Studies [CSIL]), Lead author; Gelsomina Catalano, Mario Genco, Chiara Pancotti, Emanuela Sirtori, Silvia Vignetti (CSIL); Chiara Del Bo (Universita degli Studi di Milano).

Academic Panel Review: Massimo Florio (Universita degli Studi di Milano), Panel Coordinator; Per-Olov Johansson (Stockholm School of Economics), Susana Mourato (London School of Economics & Political Science), Arnold Picot (Ludwig-Maximilians-Universitat, Munich), Mateu Turró (Universitat Politecnica de Catalunya).

Technical advisory: JASPERS acted as technical advisor to DG REGIO for the preparation of this Guide, with a focus on the practical issues related to the CBA of major infrastructure projects. In particular, besides peer reviewing the early drafts of the Guide, JASPERS contributed by highlighting best practice and common mistakes in carrying out CBA as well as with the design and development of the seven case studies included in the Guide. The JASPERS team was composed of experts in all sectors covered by the Guide. It was led by Christian Schempp and Francesco Angelini and included Patrizia Fagiani, Joanna Knast-Braczkowska, Marko Kristl, Massimo Marra, Tudor Radu, Paul Riley, Robert Swerdlow, Dorothee Teichmann, Ken Valentine and Elisabet Vila Jorda.

The authors gratefully acknowledges very helpful comments by Witold Willak, Head of Sector, G.1 Major Project Team, the European Commission Directorate-General for Regional and Urban Policy, who has been in charge of the management of the service, by Mateusz Kujawa, European Commission Directorate-General for Regional and Urban Policy, by the members of the Academic Panel Review, by experts from JASPERS and the European Investment Bank (EIB), as well as participants in the Steering Committee meetings including desk officers from the European Commission Directorates-General for Communications Networks, Content and Technology, for Climate Action, for the Environment, for Energy, for Mobility and Transport, for Regional and Urban Policy and for Research and Innovation.

In some cases, constraints of space, of time, or scope of the Guide have limited the possibility by the authors to fully include all the suggested changes to earlier drafts. The usual disclaimer applies and the authors are responsible for any remaining omissions or errors.

The European Commission and the authors accept no responsibility or liability whatsoever with regard to this text. This material is:

• information of general nature which is not intended to address the specific circumstances of any particular individual or entity;

• not necessarily comprehensive, accurate or up to date. It is not meant to offer professional or legal advice.

Reproduction or translation is permitted, provided that the source is duly acknowledged and no modifications to the text are made.

Quotation is authorised as long as the source is acknowledged along with the fact that the results are provisional.

BAU Business As Usual

CBA Cost-Benefit Analysis

CF Conversion Factor

DCF Discounted Cash Flow

EC European Commission

EIA Environmental Impact Assessment

EIB European Investment Bank

ENPV Economic Net Present Value

ERDF European Regional Development Fund

ERR Economic Rate of Return

ESI European and Structural Investment

EU European Union

FDR Financial Discount Rate

FNPV Financial Net Present Value

FRR(C) Financial Rate of Return of the Investment

FRR(K) Financial Rate of Return on National Capital

GDP Gross Domestic Product

GHG Green House Gas

IWS Integrated Water Supply

LRMC Long Run Marginal Cost

MCA Multi-Criteria Analysis

NACE Statistical classification of economic activities

MS Member State

OP Operational Programme

O&M Operation & Maintenance

PPP Public-Private Partnership

QALY Quality-Adjusted Life Year

SCF Standard Conversion Factor

SDR Social Discount Rate

STPR Social Time Preference Rate

VAT Value Added Tax

VOSL Value of Statistical Life

VOT Value of Time

WTP Willingness-to-pay

WTA Willingness-to-accept

WWTP Waste Water Treatment Plant

349

Evidence-based and successful policy requires making investment decisions based on objective and verifiable methods. This is why the Commission has been continuously promoting the use of Cost-Benefit Analyses (CBA) for major infrastructure projects above €50 million. For the first time, in the 2014-2020 period, the basic rules of conducting CBAs are included in the secondary legislation and are binding for all beneficiaries. In general, the Member States plan to implement over five hundred major projects in the 2014-2020 period.

CBA - that is about measuring in “money terms” all the benefits and costs of the project to society - should become a real management tool for national and regional authorities and therefore we have focused on practical elements in the Guide while keeping abreast of recent developments in the scientific world of welfare economics.

In addition, DG Regional and Urban Policy - together with JASPERS - will establish regular CBA forums for exchanging best practices and experience in carrying out CBAs so that we can continue to improve stakeholders' knowledge and its effective application to specific investment projects. For the sake of creating growth and jobs, Member States' projects financed by the European Structural and Investment Funds need to be completed on time and have to provide expected results to our citizens and enterprises.

I am looking forward to the successful use of EU funding in the coming years to show its added value and role in delivering the Europe 2020 strategy.

Corina Cretu,

European Commissioner for Regional Policy

The present guide to Cost-Benefit Analysis (CBA) of investment projects updates and expands the previous edition of 2008. The guide has been revised with consideration for the recent developments in EU polices and methodology for cost benefit analysis and international best practice, and builds on the considerable experience gained in project preparation and appraisal during the previous programming periods of the cohesion policy.

The objective of the guide reflects a specific requirement for the European Commission to offer practical guidance on major project appraisals, as embodied in the cohesion policy legislation for 2014-2020. As with previous versions, however, the guide should be seen primarily as a contribution to a shared European-wide evaluation culture in the field of project appraisal. Its main objective is to illustrate common principles and rules for application of the CBA approach into the practice of different sectors.

The guide targets a wide range of users, including desk officers in the European Commission, civil servants in the Member States (MS) and in candidate countries, staff of financial institutions and consultants involved in the preparation or evaluation of investment projects. The text is relatively self-contained and does not require a specific background in financial and economic analysis of capital investments. The main change with respect to the previous edition concerns a reinforced operational approach and a stronger focus on the investment priorities of the cohesion policy.

The structure of the guide is as follows.

Chapter one presents the regulatory requirements for the project appraisal process and the related decision on a major project. The project appraisal activity is discussed within the more comprehensive framework of the multi-level governance planning exercise of the cohesion policy and its recent policy developments.

Chapter two discusses the CBA guiding principles, working rules and analytical steps that shall be considered for investment appraisal under EU funds. The proposed methodological framework is structured as a suggested agenda and check-list, both from the standpoint of the investment proposer, who is involved in assessing or preparing a project dossier, and the project examiner involved in project appraisals.

Chapters three to seven include outlines of project analysis by sector, focusing on transport, environment, energy, broadband and research & innovation sectors. The aim is to make explicit those aspects of the CBA that are sector-specific, such as typical economic costs and benefits, evaluation methods, reference periods, etc.

To facilitate the understanding and practical application of CBA in the different sectors covered by the Guide, a number of cases studies are provided. The case studies are solely intended as worked examples of the general methodology described in Chapter 2 and the sector specific methodologies. Although the project examples used in the case studies may be partially based on real projects, these have been simplified and modified in many ways to fit the intended purpose, which is why they are not necessarily representative of the complexity of any real project. Also, the projects selected are only illustrative examples of a vast variety of possible project types within each infrastructure sector and should not be seen as a standard project for the given sector. Similarly, none of the specific assumptions featured in any of the case studies are meant to be seen as representative or standard for any other project, in any sector or country, but rather as illustrative examples. Finally, it should also be noted that for reasons of space limitations in this Guide, the case studies have been generally kept as short as possible and thus many details had to be left out in many ways.

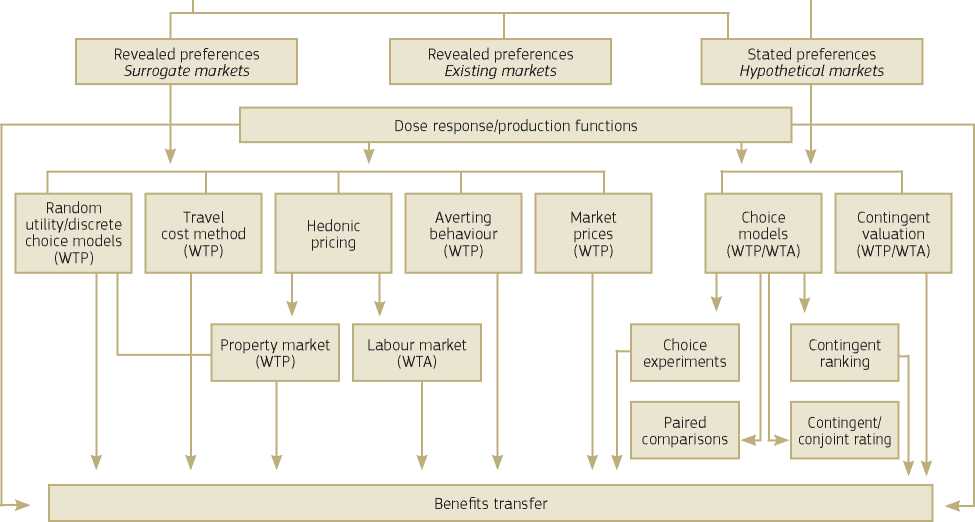

A set of annexes cover the following topics: financial discount rate; social discount rate; approaches for empirical estimation of conversion factors; shadow wage; tariff setting, polluter pays principle and affordability; willingness to pay approach; project performance indicators; probabilistic risk analysis; other appraisal tools. The text is completed by a bibliography.

The EU cohesion policy aims to deliver growth and jobs together with the targets and objectives contained within the Europe 2020 strategy. Choosing the best quality projects which offer best value for money and which impact significantly on jobs and growth is a key ingredient of the overall strategy. In this framework, Cost Benefit Analysis (CBA) is explicitly required, among other elements, as a basis for decision making on the co-financing of major projects included in operational programmes (OPs) of the European Regional Development Fund (ERDF) and the Cohesion Fund.

CBA is an analytical tool to be used to appraise an investment decision in order to assess the welfare change attributable to it and, in so doing, the contribution to EU cohesion policy objectives. The purpose of CBA is to facilitate a more efficient allocation of resources, demonstrating the convenience for society of a particular intervention rather than possible alternatives.

This chapter describes the legal requirements and scope of the CBA in the appraisal of investment projects within the EU cohesion policy, according to the EU regulations and other European Commission documents (see box below). In addition, the role of CBA in the broader framework of EU policy is discussed in light of the EU 2020 Strategy, the targets and objectives of the flagship initiatives and the main sectorial policies and cross cutting issues, including climate change and resource efficiency, in addition to synergies with other EU funding instruments such as the Connecting Europe Facility. The key contents of the chapter are:

• definition and scope of ‘major projects';

• information required, roles and responsibility for the appraisal; and

• consistency with recent policy development and cross cutting issues.

According to Article 100 (Major projects) of Regulation (EU) No 1303/2013, a major project is an investment operation comprising ‘a series of works, activities or services intended to accomplish an indivisible task of a precise economic and technical nature which has clearly identified goals and for which the total eligible cost exceeds EUR 50 million.' The total eligible cost is the part of the investment cost that is eligible for EU co-financing.1 In the case of operations falling under Article 9(7) (Thematic objectives) of Regulation (EU) No 1303/2013, the financial threshold for the identification of major project is set at EUR 75 million.

• Regulation (EU) No 1303/2013 of the European Parliament and of the Council of 17 December 2013 laying down common provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund, the European Agricultural Fund for Rural Development and the European Maritime and Fisheries Fund and laying down general provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund and the European Maritime and Fisheries Fund and repealing Council Regulation (EC) No 1083/2006.

• Commission Delegated Regulation (EU) No 480/2014 of 3 March 2014 supplementing Regulation (EU) No 1303/2013.

• Commission Implementing Regulation (EU) No 1011/2014 of 22 September 2014 laying down detailed rules for implementing Regulation (EU) No 1303/2013 of the European Parliament and of the Council as regards the models for submission of certain information to the Commission and the detailed rules concerning the exchanges of information between beneficiaries and managing authorities, certifying authorities, audit authorities and intermediate bodies (hereinafter called IR on notification procedure and IQR)

• Commission Implementing Regulation (EU) laying down detailed rules implementing Regulation (EU) No 1303/2013 of the European Parliament and of the Council as regards the models for the progress report, submission of the information on a major project, the joint action plan, the implementation reports for the Investment for growth and jobs goal, the management declaration, the audit strategy, the audit opinion and the annual control report and the methodology for carrying out the cost-benefit analysis and pursuant to Regulation (EU) No 1299/2013 of the European Parliament and of the Council as regards the model for the implementation reports for the European territorial cooperation goal (hereinafter called IR on application form and CBA methodology)

The definition of a major project does not apply to the operation of setting up a financial instrument, as defined by Article 37 (Financial instrument) of Regulation (EU) No 1303/20 1 32, which should undergo a specific procedure3. In the same vein, a Joint Action Plan, as defined by Article 104 (Joint action plan) of Regulation (EU) No 1303/20134 is not a major project. Major projects may be financially supported by the ERDF and Cohesion Fund (hereafter the Funds) as part of an OP or more than one OP (see box below). While the ERDF focuses on investments linked to the context in which firms operate (infrastructure, business services, support for business, innovation, information and communication technologies [ICT] and research applications) and the provision of services to citizens (energy, online services, education, health, social and research infrastructures, accessibility, quality of the environment)5, the Cohesion Fund supports interventions within the area of transport and environment. In the environment field, the Cohesion Fund specifically supports investment in climate change adaptation and risk prevention, investment in the water and waste sectors and the urban environment. Investments in energy efficiency and renewable energy are also eligible for support, provided it has positive environmental benefits. In the field of transport the Cohesion Fund contributes to investments in the Trans-European Transport Network, as well as low-carbon transport systems and sustainable urban transport6.

According to Article 96 (Content, adoption and amendment of operational programmes under the Investment for growth and jobs goal) of Regulation (EU) No 1303/2013, an operational programme shall set out (...) ‘a description of the type and examples of actions to be supported under each investment priority and their expected contribution to the specific objectives referred to in point (i), including the guiding principles for the selection of operations and, where appropriate, the identification of main target groups, specific territories targeted, types of beneficiaries, the planned use of financial instruments and major projects.’

As part of the operational programme(s), the implementation of major projects should be examined by the Monitoring Committee appointed for the specific programme(s) (Article 110). Progress on their preparation and implementation shall be reported in the Annual Implementation Report (Article 111), which Member States are asked to submit annually, from 2016 to 2023.

Financial instruments can be set up to finance major projects, even in combination with ERDF or Cohesion Fund grants. In the latter case separate records must be maintained for each form of financing. In addition, the applicant is asked to specify the type of financial instruments used for financing the project.

In order to get the approval for the co-financing of the major project, the managing authority (MA) of the programme(s) which submits the project is asked to make available the information referred to in Article 101 (Information necessary for the approval of a major project) of Regulation (EU) No 1303/2013 (see box).

(a) Details concerning the body responsible for implementation of the major project, and its capacity.

(b) A description of the investment and its location.

(c) The total cost and total eligible cost, taking account of the requirements set out in Article 61.

(d) Feasibility studies carried out, including options analysis, and the results.

(e) A CBA, including an economic and a financial analysis, and a risk assessment.

(f) An analysis of the environmental impact, taking into account climate change mitigation and adaptation needs, and disaster resilience.

(g) An explanation as to how the major project is consistent with the relevant priority axes of the OP or OPs concerned, and its expected contribution to achieving the specific objectives of those priority axes and the expected contribution to socio-economic development.

(h) The financing plan showing the total planned financial resources and the planned support from the Funds, the EIB, and all other sources of financing, together with physical and financial indicators for monitoring progress, taking account of the identified risks.

(i) The timetable for implementing the major project and, where the implementation period is expected to be longer than the programming period, the phases for which support from the Funds is requested during the programming period.

The information in Article 101(a to i) represents the basis for appraising the major project and determining whether

support from the Funds is justified.

According to Article 102 (Decision on a major project) of Regulation (EU) No 1303/2013, the appraisal procedure can take two different forms. It is up to the Member State to decide which of the two forms to apply for specific major projects under its OPs:

• the first option is an assessment of the major project by independent experts followed by a notification to the Commission by the MA of the major project selected. According to this procedure, the independent experts will assess the information provided on the major project according to Article 101;

• the second option is to send the major project documentation directly to the Commission, in line with the procedure of the 2007-2013 programming period. In this case, the MS shall submit to the Commission the information set out in Article 101, which will be assessed by the Commission.

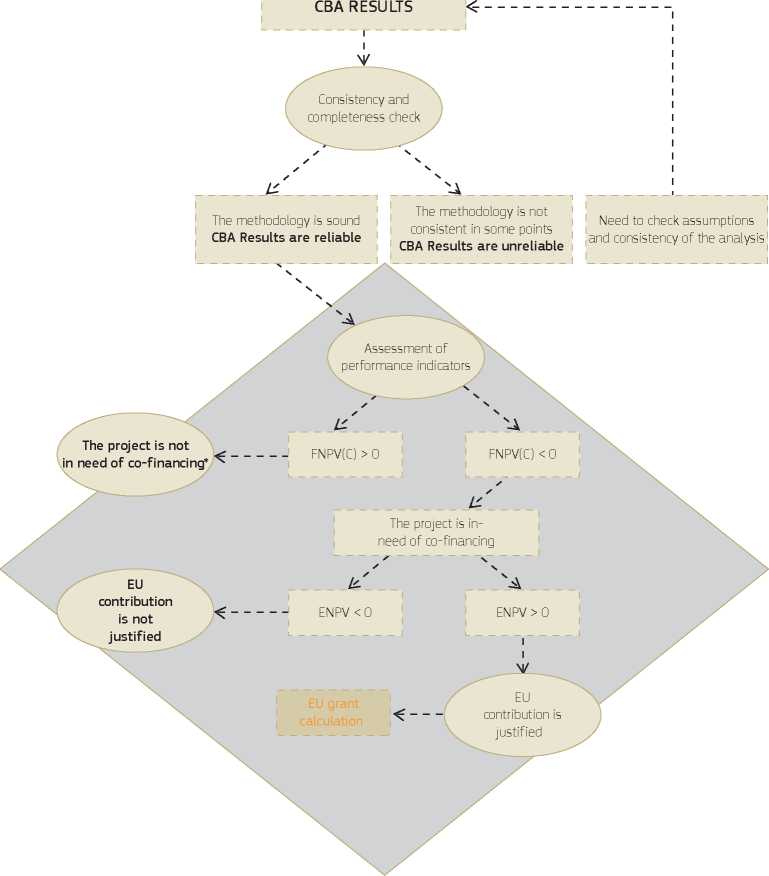

Regardless of the procedure adopted, the aim is to check that:

• the project dossier is complete, i.e. all the necessary information required by Article 101 is made available and is of sufficient quality;

• the CBA analysis is of good quality, i.e. it is coherent with the Commission methodology; and

• the results of the CBA analysis justify the contribution of the Funds.

The results of the analysis should, in particular, demonstrate that the project is the following:

• consistent with the OP. This is demonstrated by checking that the result(s) produced by the project (e.g. in terms of employment generation, carbon dioxide reduction, etc.) contribute to the specific objective(s) of the priority axis of the programme and policy goals;

• in need of co-financing. This is assessed by the financial analysis and, particularly, with the calculation of the Financial Net Present Value and the Financial Rate of Return of the Investment (FNPV(C) and FRR(C) respectively). To gain a contribution from the Funds, the FNPV(C) should be negative and the FRR(C) should be lower than the discount rate used for the analysis (except for some projects falling under State Aid rules for which this may not be relevant7);

• desirable from a socio-economic perspective. This is demonstrated by the economic analysis result and particularly by a positive Economic Net Present Value (ENPV)8.

In order to assess if the results of the CBA actually support a case for the major project approval, the CBA dossier should demonstrate that the methodology is sound and consistent. To this end, it is of paramount importance that all the information related to the CBA is made easily available and is discussed convincingly by the project beneficiary in the form of a quality CBA report, that refers to methods and tools used (including the model(s) used for calculations) as well as all the working hypotheses underpinning the analysis and especially the forecasts of future values, in addition to their sources. A quality CBA report should therefore be: self-contained (results of previous studies should be briefly recalled and illustrated); transparent (a complete set of data and sources of evidence should be made easily available); verifiable (assumptions and methods used to calculate forecast values should be made available so that the analysis can be replicated by the reviewer); and credible (based on well-documented and internationally accepted theoretical approaches and practices).

Figure 1.1 Role and responsibilities in the Major Project’s appraisal

|

Selection of the appraisal procedure |

1 l 1 | |||

|

/ N X N | ||||

|

S |

s | |||

|

s |

N | |||

|

Li' | ||||

|

\ Art. 102 (1) |

Art. 102 (2) | |||

|

procedure i |

procedure | |||

|

i y |

I y | |||

|

Makes available information referred to in Art.101 to the independent experts |

1 1 Makes available information referred to in Art. 101 and submits an Application Form to the Commission services |

|

1 ] |

1 1 |

|

y |

1 |

|

Assess the project on the basis of the information referred to in Art. 101 and produce an Independent Quality Review report |

| | | | | | | 1 | |

|

i ] y |

] ] ] |

|

r Submits a notification of the selected project to the Commission services |

| |

|

T y |

1 ] V |

|

Assesses the project on the basis of the Independent Quality Review report |

Assesses the project on the basis of the information referred to in Art. 101 with the support of the EIB (if necessary) |

|

] ] V |

] V |

The project is approved/rejected

Source: Authors

Figure 1.2 The role of CBA in the appraisal of the major project

* With exceptions, as set out in Annex III to the Implementing Regulation on application form and CBA methodology. Source: Authors

Where the major project has received a positive appraisal in a quality review by independent experts, according to Article 102(1) (Decision on a major project) of Regulation (EU) No 1303/2013, the Member State may proceed with the selection of the major project and shall notify the Commission. The Commission has 3 months to agree with the independent experts, or adopt the Commission decision refusing the financial contribution to the major project.

If the Commission appraises the major project in accordance with Article 102(2), the Commission shall adopt its decision on the approval (or rejection) of the financial contribution to the selected major project, by means of an implementing act, no later than three months from the date of submission of the information referred to in Article 101.

The co-financing rate for the priority axis, under which the major project is included, shall be fixed by the Commission when adopting the OP [Article 120 (Determination of co-financing rates) of Regulation (EU) No 1303/2013]. For each priority axis, the Commission shall set out whether the co-financing rate for the priority axis is to be applied to the total eligible expenditure (including public and private expenditure) or to the public eligible expenditure. As stated in Article 65 (Eligibility) of Regulation (EU) No 1303/2013, the eligible expenditure of an operation, including major projects, is determined on the basis of national rules ‘except where specific rules are laid down in, or on the basis of, this Regulation or the Fund-specific rules'. Also, specific provisions apply in the case of revenue-generating projects (see box).

The financing method and appraisal procedure of major projects has therefore changed with respect to the 2007-2013 programming period. Table 1.3, displayed at the end of the chapter, highlights the main differences introduced by the new regulations as compared to the Council Regulation 1083/2006.

Revenue-generating projects are investment operations in which discounted revenues are higher than discounted operating costs. According to Article 61 (Operations generating net revenue after completion) of Regulation (EU)

No 1303/2013, the eligible expenditure to be co-financed from the Funds shall be reduced, taking into account the potential of the operation to generate net revenue over a specific reference period that covers both implementation of the operation and the period after completion. The potential net revenue of the operation shall be determined in advance by one of the following methods:

1) Application of a flat rate for the net revenue percentage. It is a simplified approach as compared to the previous programming period.

2) Calculation of discounted net revenue of the operation. This is the method used in the 2007-2013 programming period, in accordance with Article 55 of the Council Regulation 1083/2006.

3) Application of reduced co-financing rates for particular priority axes.

Where it is not objectively possible to determine the revenue in advance according to these methods, Article 61 states that ‘the net revenue generated within three years of the completion of an operation [...] shall be deducted from the expenditure declared to the Commission.’

It should be noted that Article 61 does not apply to operations for which support under the programme constitutes:

(a) de minimis aid; (b) compatible State aid to small and medium-sized businesses (SMEs), where an aid intensity or an aid amount limit is applied in relation to State aid; or (c) compatible State aid, where an individual verification of financing needs in accordance with the applicable State aid rules has been carried out.

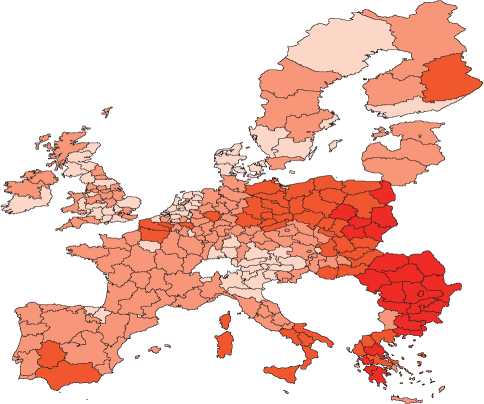

For the 2014-2020 programming period, cohesion policy and its Funds are deemed to be a key delivery mechanism to achieve the objectives of Europe 2020 strategy9' As stated in Article 18 (Thematic concentration) of Regulation (EU) No 1303/2013, Member States shall concentrate the EU support (in accordance with the Fund's-specific rules) on actions that bring the greatest added value in relation to the Europe 2020 priorities of smart growth, sustainable growth and inclusive growth.

The EU has set five ambitious targets - in the fields of employment, innovation, education, social inclusion and climate/ energy - which are to be achieved at EU level by 2020. To meet these targets, the Commission proposed a Europe 2020 agenda consisting of seven flagship initiatives representing the investment areas supporting the Europe 2020 priorities. These include: innovation; digital economy; employment; youth; industrial policy; and poverty and resource efficiency.

Actions under the smart growth priority will require investments aimed at strengthening research performance, promoting innovation and knowledge transfer throughout the Union, making full use of ICTs, ensuring that innovative ideas can be turned into products and services that create growth, improving education quality. Investments in specific sectors, such as R&D, ICT and education are considered to be of major strategic importance in the promotion of this objective;

To achieve sustainable growth, it is necessary to invest in operations aimed at limiting emissions and improving resource efficiency. All sectors of the economy, not just emission-intensive ones, are concerned. Environmental measures in water and waste management, investments related to transport and energy infrastructures, as well as instruments based on the use of ICT, are expected to contribute to the shift towards a resource efficient and low-carbon economy. A further step towards sustainable growth will be achieved by supporting manufacturing and service industries (such as tourism) in seizing the opportunities presented by globalisation and the green economy;

Inclusive growth priority requires actions aimed at modernising and strengthening the employment and social protection systems. In particular, this priority specifically addresses the challenge of demographic change by increasing labour participation and reducing structural unemployment (especially for women, young people and older workers). In addition, it will address the challenges of a low skilled workforce and marginalisation (e.g. children and elderly who are particularly exposed to the risk of poverty). In this regard, investments in social infrastructure, including childcare, healthcare, culture and education facilities, will help improve skills. This will enable citizens to balance work with their private lives, and will reduce social exclusion and health inequalities, thus ensuring that the benefits gained from growth can be enjoyed by everyone;

Table 1.1. shows how specific investment sectors are related to the Europe 2020 priorities, flagship initiatives and targets. Within this context, major projects play a key role and their appraisal should be seen as part of a larger planning exercise aimed at identifying the contribution of the project to the achievement of the Europe 2020 strategy. In addition, the projects must comply with EU legislation (e.g. public procurement, competition and State-aid) and sectorial policies.

Finally, all sectors and investments are required to comply with EU climate policy. Climate change issues, both mitigation and adaptation aspects, must be taken into account during the preparation, design and implementation of major projects. That is, major projects shall contribute to the progressive achievement of emissions reduction targets by 2050. Accordingly, in the context of the co-financing request, MAs are required to explain how mitigation and adaptation needs have been taken into account when preparing and designing the project. Second, major projects should be climate-resilient: the possible impacts of the changing climate have to be assessed and addressed at all stages of their development. In the context of the co-funding request, MAs are required to explain which measures have been adopted in order to ensure resilience to current climate variability and future climate change.

Overall, the CBA provides key support in assessing the contribution of the projects to the achievement of Europe 2020 targets. Table 1.2 below shows how certain effects may be identified and quantified through the CBA.

Table 1.1 Matching Investment sectors and Europe 2020 priorities/flagships/targets

|

Europe 2020 priorities |

Europe 2020 flagship initiatives |

Sector/investments |

Europe 2020 targets | ||||

|

Employment |

Innovation |

Climate change |

Education |

Poverty | |||

|

Smart Growth |

Innovation Union |

- Research, Technological Development and Innovation |

V |

V |

V | ||

|

Youth on the move |

- Education |

V |

V | ||||

|

Digital Agenda for Europe |

- ICT |

V |

V | ||||

|

Sustainable Growth |

Resource efficient Europe |

- Environment - Energy - Transport |

V |

V |

V | ||

|

An industrial policy for the globalisation era |

- Entrepreneurship - Industry |

V |

V |

V | |||

|

Inclusive Growth |

An agenda for new skills and jobs |

- Culture - Childcare |

V |

V | |||

|

European Platform against poverty |

- Health - Housi ng |

V | |||||

Source: Authors

Table 1.2 The role of the CBA in contributing towards the achievement of the EU objectives

|

Europe 2020 Targets |

Effects quantifiable through the CBA |

Guide Section |

|

Employment |

The effect, in terms of employment used by the project, is captured by applying the Shadow Wage Conversion Factor to labour cost. The effect, in terms of employment spilling over from the project, is captured by the additional profit created, e.g. by new spin-off companies. |

Par. 2.8.5 Annex IV Par. 7.8.3 |

|

Innovation |

The contribution to the innovation objective is assessed by: - the economic returns generated by license deals; and - the technological progress generated by the project. |

Par. 7.8.3 |

|

Climate change |

The responses to climate change are assessed by estimating costs and benefits of integrating: - climate change mitigation measures, by measuring the economic value of greenhouse gas (GHG) emissions emitted in the atmosphere and the opportunity cost of the energy supply savings; - climate change adaptation measures, resulting from the assessment of the project’s risk-exposure and vulnerability to climate change impacts. |

Par. 2.6.3 Par. 2.8.8 |

|

Education |

The contribution to a higher level of education is assessed by estimating the expected increased income of students and researchers due to better positioning on the job market, as well as the economic value of knowledge outputs (e.g. scientific articles). |

Par. 7.8.4 |

|

Poverty |

Effects on poverty reduction may be assessed by evaluating the equity dimension of the project through the consideration of the households affordability (ability-to-pay), in particular the less wealthy, to access a given public service and the computation of a set of welfare weights. |

Annex V |

Source: Authors

Table 1.3 Main changes compared to the 2007-2013 programming period

|

2007 - 2013 (Regulation 1083/2006) |

2014 - 2020 (Regulation 1303/2013) | |

|

Major project threshold |

Operations where the total cost exceeds EUR 50 million (Art. 39). |

Operations where the eligible cost exceeds EUR 50 million and, in the case of operations contributing to the thematic objective under Article 9(7), EUR 75 million (Art. 100). |

|

Inclusion of major projects in the OP |

The major project is financed as part of an OP or OPs (Art. 39). The list of major projects contained in the OP is indicative. |

The major project is financed as part of an OP or OPs. In addition it can be supported by more than 1 priority axis within the OP. Major projects notified to the Commission under paragraph 1, or submitted for approval under paragraph 2, shall be contained in the list of major projects in an OP (Art. 102). |

|

Project appraisal and decision process |

- Submission: MS submits a major project application to the EC. The COM appraises the major project application on the basis of the information referred in Art. 40 and, if necessary, consulting outside experts including the EIB. - Decision: The Commission adopts a decision within three months. If the Commission appraises the major project and it does not comply with the Regulations, the MS is requested to withdraw the application. Alternatively, the Commission may adopt a negative decision. (Art. 41) |

- Article 102 (1) procedure: at the level of the MS, if the MS decides, the major project is assessed by independent experts supported by technical assistance or, in agreement with the Commission, by other independent experts. The MS notifies the Commission about the results by presenting the information required in Article 101. The Commission approves or refuses the MS’s selection of the major project within three months. In the absence of a decision, the project is deemed approved after three months from its notification (Art. 101). - Article 102 (2) procedure: o The MS sends major project application to the Commission. The Commission appraises and adopts a decision approving or refusing the MS selection of the major project within three months (Art.102). o For an operation which consists of the second or subsequent phase of a major project for which the preceding phase was approved by the Commission and there are no substantial changes compared to the information provided for the major project application submitted in the previous period, in particular as regards the total eligible cost, the MS may proceed with the selection of the major project in accordance with Art. 125(3) and submit the notification containing all the elements, together with confirmation that there are no substantial changes in the major project. No assessment of the information by independent experts is required (Art. 103) |

|

Payment applications |

Expenditure relating to major projects can be included in payment applications before the project has been approved by a Commission decision. |

Expenditure relating to major projects may be included in payment applications only after the MA notifies to the Commission of the major project decision or following the submission for major project application approval. |

|

Validity of Commission approval |

A Commission decision on a major project is valid for the entire programming period. |

Approval by the Commission shall be conditional on the first works/PPP contract being concluded within three years of the date of the approval of the project by the Commission. The deadline could be extended in duly motivated cases by not more than two years. |

|

Calculation of net revenue |

One possibility: - Calculation of discounted net revenues (Art. 55). |

Three possibilities: - Calculation of discounted net revenues - Flat rate net revenue percentage - Decreasing co-financing rate for a chosen priority axis (Art. 61). |

Source: Authors

KJ

4^

GUIDE TO COST-BENEFIT ANALYSIS OF INVESTMENT PROJECTS

Cost-Benefit Analysis (CBA) is an analytical tool for judging the economic advantages or disadvantages of an investment decision by assessing its costs and benefits in order to assess the welfare change attributable to it.

The analytical framework of CBA refers to a list of underlying concepts which is as follows:

• Opportunity cost. The opportunity cost of a good or service is defined as the potential gain from the best alternative forgone, when a choice needs to be made between several mutually exclusive alternatives. The rationale of CBA lies in the observation that investment decisions taken on the basis of profit motivations and price mechanisms lead, in some circumstances (e.g. market failures such as asymmetry of information, externalities, public goods, etc.), to socially undesirable outcomes. On the contrary, if input, output (including intangible ones) and external effects of an investment project are valued at their social opportunity costs, the return calculated is a proper measure of the project's contribution to social welfare.

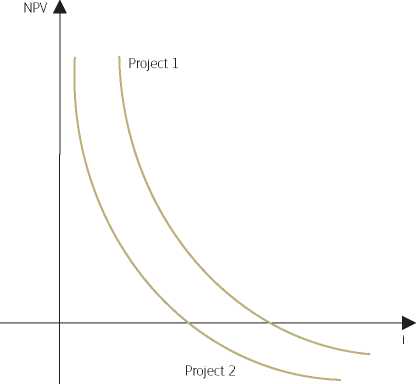

• Long-term perspective. A long-term outlook is adopted, ranging from a minimum of 10 to a maximum of 30 years or more, depending on the sector of intervention. Hence the need to:

- set a proper time horizon;

- forecast future costs and benefits (looking forward);

- adopt appropriate discount rates to calculate the present value of future costs and benefits;

- take into account uncertainty by assessing the project's risks.

Although, traditionally, the main application is for project appraisal in the ex-ante phase, CBA can also be used for in medias res and ex post evaluation10.

• Calculation of economic performance indicators expressed in monetary terms. CBA is based on a set of

predetermined project objectives, giving a monetary value to all the positive (benefits) and negative (costs) welfare effects of the intervention. These values are discounted and then totalled in order to calculate a net total benefit. The project overall performance is measured by indicators, namely the Economic Net Present Value (ENPV), expressed in monetary values, and the Economic Rate of Return (ERR), allowing comparability and ranking for competing projects or alternatives.

• Microeconomic approach. CBA is typically a microeconomic approach enabling the assessment of the project's impact on society as a whole via the calculation of economic performance indicators, thereby providing an assessment of expected welfare changes. While direct employment or external environmental effects realised by the project are reflected in the ENPV, indirect (i.e. on secondary markets) and wider effects (i.e. on public funds, employment, regional growth, etc.) should be excluded. This is for two main reasons:

- most indirect and/or wider effects are usually transformed, redistributed and capitalised forms of direct effects; thus, the need to limit the potential for benefits double-counting;

- there remains little practice on how to translate them into robust techniques for project appraisal, thus the need to avoid the analysis relies on assumptions whose reliability is difficult to check.

It is recommended, however, to provide a qualitative description of these impacts to better explain the contribution of the project to the EU regional policy goals.11

• Incremental approach. CBA compares a scenario with-the-project with a counterfactual baseline scenario

without-the-project. The incremental approach requires that:

- a counterfactual scenario is defined as what would happen in the absence of the project. For this scenario, projections are made of all cash flows related to the operations in the project area for each year during the project lifetime. In cases where a project consists of a completely new asset, e.g. there is no pre-existing service or infrastructure, the without-the-project scenario is one with no operations. In cases of investments aimed at improving an already existing facility, it should include the costs and the revenues/benefits to operate and maintain the service at a level that it is still operable (Business As Usual12 (BAU)) or even small adaptation investments that were programmed to take place anyway (do-minimum13). In particular, it is recommended to carry out an analysis of the promoter's historical cash-flows (at least previous three years) as a basis for projections, where relevant. The choice between BAU or do-minimum as counterfactual should be made case by case, on the basis of the evidence about the most feasible, and likely, situation. If uncertainty exists, the BAU scenario shall be adopted as a rule of thumb. If do-minimum is used as counterfactual, this scenario should be both feasible and credible, and not cause undue and unrealistic additional benefits or costs. As illustrated in the box below the choice made may have important implications on the results of the analysis;

- secondly, projections of cash-flows are made for the situation with the proposed project. This takes into account all the investment, financial and economic costs and benefits resulting from the project. In cases of pre-existing infrastructure, it is recommended to carry out an analysis of historical costs and revenues of the beneficiary (at least three previous years) as a basis for the financial projections of the with-project scenario and as a reference for the without-project scenario, otherwise the incremental analysis is very vulnerable to manipulation;

- finally, the CBA only considers the difference between the cash flows in the with-the-project and the counterfactual scenarios. The financial and economic performance indicators are calculated on the incremental cash flows only14.

The rest of the chapter presents the conceptual framework of a standard CBA15, i.e. the ‘steps' for project appraisal, enriched with focuses, didactical examples or shortcuts, presented in boxes, to support the comprehension and practical application of the steps proposed. At the end of each section, a review of good practices and common mistakes drawn from empirical literature, ex post evaluations and experience gained from major projects funded during the 2007-13 programming period, is also illustrated. A checklist that can be used as useful tool for checking the quality of a CBA closes the chapter. 11 12 13 14 15

The following example, adapted from EIB (2013)16, illustrates the issue of the project performance in relation to what scenario is selected as counterfactual.

The proposed project, which consists of rehabilitating and expanding existing infrastructure capacity, involves investing EUR 450 million and will result in benefits growing by 5 % per year. The ‘do-minimum’ scenario, which consists of only rehabilitating existing capacity, involves investing EUR 30 million, followed by constant benefits. The BAU involves no investment at all, which, in turn, will affect the amount of output the facility can produce, causing a fall in net benefits of 5 % per year.

As shown below, the results of the CBA change significantly if different scenarios are adopted as counterfactual. By comparing the proposed project with the ‘do-minimum’ scenario, the ERR equals 3 %. If the BAU is taken as a reference, the ERR increases to 6 %. Thus, any choice should be duly justified by the project promoter on the basis of clear evidence about the most feasible situation that would occur in the absence of the project.

|

Scenarios |

EUR m |

NPV |

1 |

2 |

10 |

21 | |

|

1 |

Proposed project |

Net benefit |

1,058 |

45 |

47 |

70 |

119 |

|

Investment |

435 |

450 | |||||

|

2 |

Do-minimum |

Net benefit |

661 |

45 |

45 |

45 |

45 |

|

Investment |

29 |

30 | |||||

|

3 |

Business As Usual |

Net benefit |

442 |

45 |

43 |

28 |

16 |

|

Investment |

0 | ||||||

|

Results | |||||||

|

1-2 |

Proposed project net of Do-minimum |

Net flows |

-9 |

-420 |

2 |

25 |

74 |

|

ERR |

3% | ||||||

|

1-3 |

Proposed project net of Business As Usual |

Net flows |

182 |

-450 |

4 |

42 |

103 |

|

ERR |

6% |

Source: EIB (2013)

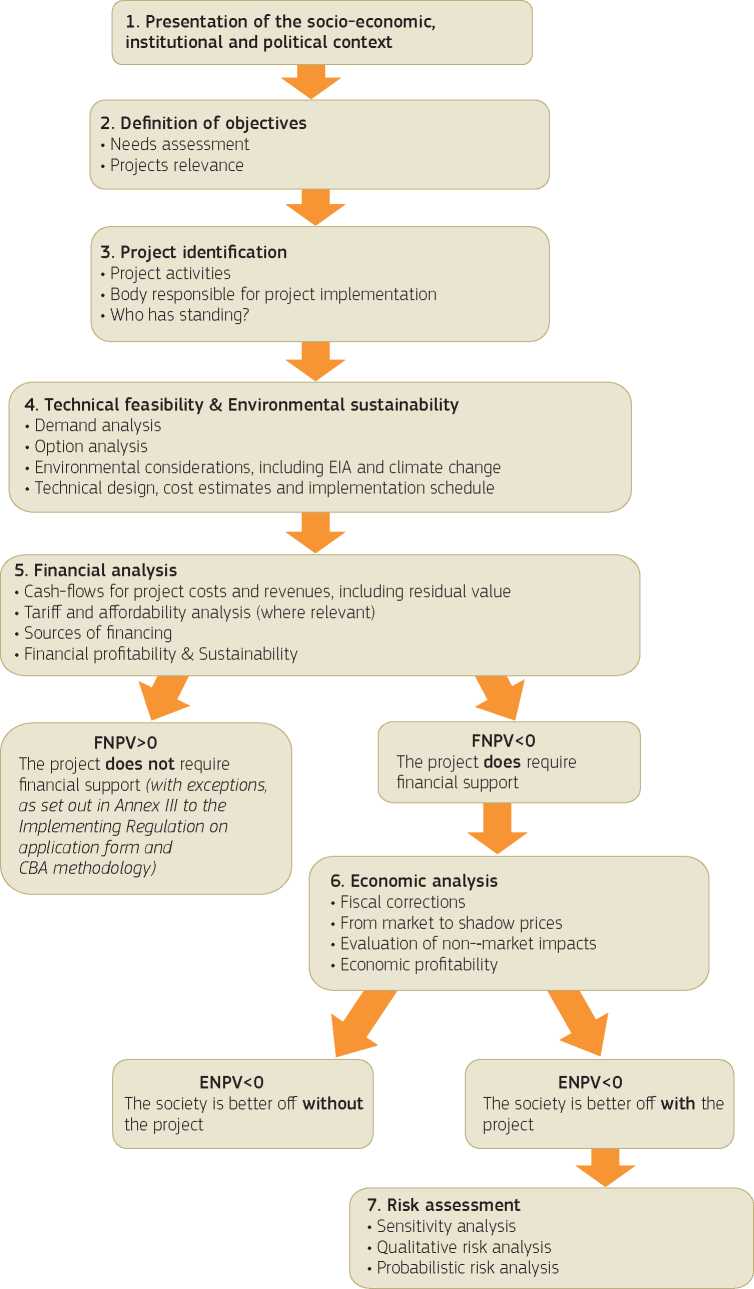

Standard CBA is structured in seven steps:

1. Description of the context

2. Definition of objectives

3. Identification of the project

4. Technical feasibility & Environmental sustainability

5. Financial analysis

6. Economic analysis

7. Risk assessment.

The following sections illustrate, in detail, the scope of each step.

Figure 2.1 The steps of the appraisal

Source: Authors

The first step of the project appraisal aims to describe the social, economic, political and institutional context in which the project will be implemented. The key features to be described relate to:

• the socio-economic conditions of the country/region that are relevant for the project, including e.g. demographic dynamics, expected GDP growth, labour market conditions, unemployment trend, etc.;

• the policy and institutional aspects, including existing economic policies and development plans, organisation and management of services to be provided/developed by the project, as well as capacity and quality of the institutions involved;

• the current infrastructure endowment and service provision, including indicators/data on coverage and quality of services provided, current operating costs and tariffs/fees/charges paid by users, if any17;

• other information and statistics that are relevant to better qualify the context, for instance, existence of environmental issues, environmental authorities likely to be involved, etc.;

• the perception and expectations of the population with relation to the service to be provided, including, when relevant, the positions adopted by civil society organisations.

The presentation of the context is instrumental to forecast future trends, especially for demand analysis. In fact, the possibility of achieving credible forecasts about users, benefits and costs often relies on the assessment's accuracy of the macro-economic and social conditions of the region. In this regard, an obvious recommendation is to check that the assumptions made, for instance on GDP or demographic growth, are consistent with data provided in the corresponding OP or other sectorial and/or regional plans of the Member State.

Also, this exercise aims to verify that the project is appropriate to the context in which it takes place. Any

project is integrated in pre-existing systems with its own rules and features, and this is an imminent complexity that cannot be disregarded. Investments to provide services to citizens can achieve their goals through the integration of either new or renewed facilities into already existing infrastructures. Partnership with the various stakeholders intervening in the system is thus a necessity. Also, sound economic policy, quality institutions and strong political commitment can help the implementation and management of the projects, and the achievement of larger benefits. In short, investments are easier to carry out where the context is more favourable. For this reason, the specific context characteristics need to be taken into due consideration starting from the project design and appraisal phase. In some cases, improvements in the institutional set up might be needed to ensure an adequate project performance.

✓ The context is presented including all sectors that are relevant to the project and avoiding unnecessary discussions on sectors that are unrelated to the project.

✓ The existing infrastructure endowment and service provision is presented with relevant statistics.

✓ The sectorial and regional characteristics of the service to be provided are presented in light of the existing development plans.

X Socio-economic context and statistics are presented without explaining their relevance for the project.

X Socio-economic statistics and forecasts are not based on readily available official data and forecasts.

X The political and institutional aspects are considered irrelevant and not adequately analysed and discussed.

The second step of the project appraisal aims to define the objectives of the project.

From the analysis of all the contextual elements listed in the previous section, the regional and/or sectorial needs that can be addressed by the project must be assessed, in compliance with the sectorial strategy prepared by the MS and accepted by the European Commission. The project objectives should then be defined in explicit relation to needs18. In other words, the needs assessment builds upon the description of the context and provides the basis for the objective's definition.

As far as possible, objectives should be quantified through indicators and targeted19, in line with the result orientation principle of the Cohesion Policy. They may relate, for example, to improvement of the output quality, to better accessibility to the service, to the increase of existing capacity, etc. For a detailed illustration of the typical objectives per sector see chapters three to seven.

A clear definition of the project objectives is necessary to:

• identify the effects of the project to be further evaluated in the CBA. The identification of effects should be linked to the project's objectives in order to measure the impact on welfare. The clearer the definition of the objectives, the easier the identification of the project and its effects. Objectives are highly relevant for the CBA, which should reveal to what extent they are met;

• verify the project’s relevance. Evidence should be provided that the project's rationale responds to a priority for the territory. This is achieved by checking that the project contributes to reaching the EU policy goals and national/regional long-term development plans in the specific sector of assistance. Reference to these strategic plans should demonstrate that the problems are recognised and that there is a plan in place to resolve them.

Whenever possible, the relationship or, better, the relative contribution of the project objectives to achieve the specific targets of the OPs should be clearly quantified. Such identification will also enable the linking of the project objectives with the monitoring and evaluation system. This is particularly important for reporting the progress of major projects in the annual implementation reports, as requested by Article 111 (Implementation reports for the Investment for growth and jobs goal) of Regulation (EU) No 1303/2013. In addition, according to the most recent policy development of the European and Structural

Investment (ESI) Funds, the promoter should also show how and to what extent the project will contribute to achieving the targets of any national or regional sectorial programme.

GOOD PRACTICES

✓ Project effects are identified in clear relation to the project objectives.

✓ The general objectives of the project are quantified with a system of indicators and targets.

✓ Target values are established and compared to the situations with- and without-the-project.

✓ Project indicators are linked to those defined in the respective OP and priority axis. Where the indicators set at the level of the OP are inappropriate to measure the impact of specific projects, additional project-specific indicators, are set up.

✓ If a region or country-wide target exists (e.g. 100 % coverage of water supply in a given service area, diversion of minimum 50 % of biodegradable waste from landfill, etc.), the contribution of the project to achieving this wider target (in % of total target) is explained.

✓ Source and values of indicators are explained.

COMMON MISTAKES

X The economic effects considered in the CBA are not well aligned with the specific objectives of the project.

X Project objectives are confused with its outputs. For instance, if the main objective of the project is to improve the accessibility of a peripheral area, the construction of a new road or the modernisation of the existing network are not objectives, but the means through which the objective of improving the area’s accessibility will be accomplished.

X Where the investment is compliance driven (e.g. UWWTD20), the extent to which the project contributes to achieve such compliance is not shown. If the required standards are not attained by the project, evidence of what other measures are planned and how they will be financed must be provided.

Section 1.2 has presented the legal basis for the definition of a project. Here, some analytical issues involved in project identification are developed. In particular, a project is clearly identified when:

• the physical elements and the activities that will be implemented to provide a given good or service, and to achieve a well-defined set of objectives, consist of a self-sufficient unit of analysis;

• the body responsible for implementation (often referred to as ‘project promoter' or ‘beneficiary') is identified and its technical, financial and institutional capacities analysed; and

• the impact area, the final beneficiaries and all relevant stakeholders are duly identified (‘who has standing?').

A project is defined as ‘as a series of works, activities or services intended in itself to accomplish an indivisible task of a precise economic or technical nature which has clearly identified goals' (Article 100 (Content) of Regulation (EU) No 1303/2013). These works, activities or services should be instrumental in the achievement of the previously defined objectives. A description of the type of infrastructure (railway line, power plant, broadband, waste water treatment plant, etc.), type of intervention (new construction, rehabilitation, upgrade, etc.), service provided (cargo traffic, urban solid waste management, access to broadband for businesses, cultural activities, etc.) and location should be provided in order to define the project activities.

In this regard, the key aspect is that appraisal needs to focus on the whole project as a self-sufficient unit of analysis, which is to say that no essential feature or component is left outside the scope of the appraisal (under-scaling). For example, if there are no connecting roads for waste delivery, a new landfill will not be operational. In that case, both the landfill and the connecting roads are to be considered as a unique project. In general, a project can be defined as technically self-sufficient if it is possible to produce a functionally complete infrastructure and put a service into operation without dependence on other new investments. At the same time, including components in the project that are not essential to provide the service under consideration should be avoided (over-scaling).

The application of this principle requires that:

• partitions of project for financing, administrative or engineering reasons are not appropriate objects of appraisal (‘half a bridge is not a bridge'). A typical case might be that of a request for EU financial support for the first phase of an investment, whose success hinges on the completion of the project as a whole. Or, a request for EU financial support for only a part of a project because the remaining will be financed by other sponsors. In these cases, the whole investment should be considered in CBA. The appraisal should focus on all the parts that are logically connected to the attainment of the objectives, regardless of what the aim of the EU assistance is.

• inter-related but relatively self-standing components, whose costs and benefits are largely independent, should be appraised independently. Sometimes a project consists of several inter-related elements. For example, the construction of a green park area including solid waste management and recreational facilities. Appraising such a project involves, firstly, the consideration of each component independently and, secondly, the assessment of possible combinations of components. The measurement of the economic benefits of individual project components is particularly relevant in the context of large multifaceted projects (see box below). As a whole these projects may present a net positive economic benefit (i.e. a positive ENPV). However, this positive ENPV may include one or more project components that have a negative ENPV. If this component(s) is not integral to the overall project, then excluding it will increase the ENPV for the rest of the project.

• future planned investments should be considered in the CBA if they are critical for ensuring the operations of the original investment. For example, in the case of wastewater treatment, a capacity upgrade of the original plant shall be factored in at a certain point of the project's life cycle, if it is needed to comply with an expected population increase, in order to continue to meet the original project's objectives.

The main driver of the improvement of a railway line is its electrification in order to improve its performance and its integration into the electrified network. Given that the construction works will generate some service disruptions, the project incorporates other actions on the line such as alignment improvements, track reconstruction and the adoption of the ERMTS signalling system. The CBA should consider all these investments and their effects.

EU assistance can be designed to co-finance the reorganisation of some water subnets as part of a broader intervention financed with several sponsors and concerning the entire municipality’s water supply network. The larger intervention should be considered as the unit of the analysis.

A system of integrated environmental regeneration which envisages the construction of several waste water treatment plants and the installation of sewage pipelines and pumping stations in different municipalities can be considered as one integrated project if the single components are integral to the achievement of the environmental regeneration of the impact area.

In the context of urban development, the rehabilitation of city walls and streets in the historical centre of a town should be appraised independently from the rehabilitation and adaptation of buildings for commercial activities in the same area.

The project owner, i.e. the body responsible for project implementation, should be identified and described in terms of its technical, financial and institutional capacity. The technical capacity refers to the relevant staff resources and staff expertise available within the organisation of the project promoter and allocated to the project to manage its implementation and subsequent operation. In the case of the need to recruit additional staff, evidence should be provided that no constraints exist to find the necessary skills on the local labour market. The financial capacity refers to the financial standing of the body, which should demonstrate that it is able to guarantee adequate funding both during implementation and operations. This is particularly important when the project is expected to require substantial cash inflow for working capital or other financial imbalances (e.g. medium-long term loan, clearing cycle of VAT, etc.). The institutional capacity refers to all the institutional arrangements needed to implement and operate the project [e.g. set up of a Project Implementation Unit (PIU)] including the legal and contractual issues for project licensing. Where necessary, special external technical assistance may need to be foreseen and included in the project.

When the infrastructure owner and its operator are different, a description of the operating company or agency who will manage the infrastructure (if already known) and its legal status, the criteria used for its selection, and the contractual arrangements foreseen between the partners, including the funding mechanisms (e.g. collection of tariffs/service fees, presence of government subsides), should be provided.

After having described the project activities and the body responsible for project implementation, the boundaries of the analysis should be defined. The territorial area affected by the project effects is defined as the impact area. This can be of local, regional or national (or even EU) interest, depending on the size and scope of the investment, and the capacity of the effects to unfold. Although generalisations should be avoided, projects typically belonging to some sectors have a common scope of effects. For example, transport investments such as a new motorway (the same does not usually apply to urban transport), even if implemented within a regional framework, should be analysed from a broader perspective since they usually form part of an integrated network that may extend beyond the geographical scope of the analysis. The same can be said for an energy plant serving a delimited territory but belonging to a wider system. In contrast, water supply and waste management projects are more frequently of local interest. However, all projects must incorporate a wider perspective when dealing with environmental issues related to CO2 and other greenhouse gas (GHG) emissions with effects on climate change, which are intrinsically non-local.

A good description of the impact area requires the identification of the project's final beneficiaries, i.e. the population that benefits directly from the project. These may include, for example, motorway users, households exposed to a natural risk, companies using a science park, etc. It is recommended to explain what type of benefits will be enjoyed and to quantify them as much as possible. The identification of the final beneficiaries should be consistent with the assumptions of the demand analysis (see section 2.7.1).

In addition, all bodies, public and private, that are affected by the project need to be described. Large infrastructure investment does not usually only affect the producer and the direct consumers of the service, but can generate larger effects (or ‘reactions') e.g. on partners, suppliers, competitors, public administrations, local communities, etc. For instance, in the case of a high speed train linking two major cities, local communities along the train layout may be affected by negative environmental impacts, while the benefits of the project are accrued by the inhabitants of the larger areas. The identification of ‘who has standing’ should account for all the stakeholders who are significantly affected by the costs and benefits of the project. For a more detailed discussion about how to integrate distributional effects in the CBA see section 2.9.11.

16

✓ Where a project has several stages or phases, these are properly presented together with their respective costs and benefits.

✓ Individual investment measures are bundled into one single project when these are: i) integral to the achievement of the intended objectives and complementary from a functional point of view; ii) implemented in the same impact area; iii) share the same project owner; and iv) have similar implementation periods.

X An artificial splitting of the project is adopted to reduce the project investment cost in order to fit under the major projects threshold.

X Project over-scaling: investments which are functionally independent of each other are packaged together

without a preliminary verification of the economic viability of each investment and of possible combinations and without a clear functional and strategic link among them.

X Project under-scaling: a request for assistance is presented for financing a portion of a project which cannot be justified in isolation from other functional elements.

X Project over-sizing due to over-optimistic assessment of the impact area, e.g. on the basis of unrealistic assumptions of demographic growth.

X The institutional set-up for project operations is presented unclearly.This will make it difficult to verify that financial cash flows are properly accounted for in the financial analysis.

X Benefits of a second phase of a project are included in the economic analysis of the first phase without also including the additional costs, thus making the first phase look economically and/or financially more attractive.

Technical feasibility and environmental sustainability are among the elements of information to be provided in the funding request for major projects (Article 101 (Information necessary for the approval of a major project) of Regulation (EU) No 1303/2013). Although both analyses are not formally part of the CBA, their results must be concisely reported and used as a main data source within the CBA (see box). Detailed information should be provided on:

• demand analysis;

• options analysis;

• environment and climate change considerations;

• technical design, cost estimates and implementation schedule.

In the following, a review of the key information that needs to be summarised in the CBA, in order to understand the overall justification of the project solution sought, is provided. Although they are presented consecutively, they should be viewed as parts of an integrated process of project preparation, where each piece of information and analysis feed each other into a mutual-learning exercise (see box).

The CBA principles should be adopted in the project design process as soon as possible. The CBA should be understood as an ongoing, multi-disciplinary, exercise performed throughout the project preparation in parallel with other technical and environmental considerations. Prerequisites for the CBA of the proposed project solution are, however, the finalisation of a detailed demand analysis and the availability of investment and operational and management (O&M) cost estimates, including costs for environmental mitigation and adaptation measures. These are based on the preliminary project design, which are centrepieces of the ‘technical’ feasibility study and the EIA.

This does not necessarily mean that the analysts responsible for preparing the CBA should start working after the engineers complete the preliminary technical design and deliver the cost estimates, but rather in parallel. In fact, analysts preparing the CBA should adopt an interdisciplinary approach to project preparation from an early stage and are usually involved in preliminary, simplified CBAs for comparisons of different technical and environmental options. Their involvement in the preparation of the demand analysis and options analysis is useful (and often decisive) in achieving the best results for the project.

Once the optimal project solution is identified, a full-scale CBA is usually performed at the end of the preliminary design stage. The aim is to provide confirmation to the project planner(s) of the adequacy and economic convenience of the proposed solution to meet the pre-established project objectives. The results of the full-scale CBA, based on the most recent cost estimates, shall be presented in the EU request for co-financing.

Demand analysis identifies the need for an investment by assessing:

• current demand (based on statistics provided by service suppliers/ regulators/ ministries/ national and regional statistical offices for the various types of users);

• future demand (based on reliable demand forecasting models that take into consideration macro- and socio-economic forecasts, alternative sources of supply, elasticity of demand to relevant prices and income, etc.) in both the scenarios with- and without-the-project.

Both quantifications are essential to formulate demand projections, including generated/induced demand where relevant21, and to design a project with the appropriate productive capacity. For example, it is necessary to investigate which share of the demand for public services, rail transport, or disposal of waste material can be expected to be satisfied by the project. Demand hypotheses should be tested by analysing the conditions of both the present and future supply, which may be affected by actions that are independent from the project.

For a detailed discussion about the main factors affecting demand, methods and outputs of demand analysis in the different fields of intervention see chapters three to seven.

Particular attention should be paid to identifying whether the project under consideration belongs to networks. This is particularly the case for transport and energy infrastructures, which always form part of networks, but also for ICT and telecommunication projects.

When projects belong to networks, their demand (and consequently their financial and economic performance) is highly influenced by issues of mutual dependency (projects might compete with each other or be complementary) and accessibility (ease of reaching the facility).

Several techniques (e.g. multiple regression models, trend extrapolations, interviewing experts, etc.) can be used for demand forecasting, depending on the data available, the resources that can be dedicated to the estimates and the sector involved. The selection of the most appropriate technique will depend, amongst other factors, on the nature of the good or service, the characteristics of the market and the reliability of the available data. In some case, e.g. transport, sophisticated forecast models are required.

Transparency in the main assumptions, as well in the main parameters, values, trends and coefficients used in the forecasting exercise, are matters of considerable importance for assessing the accuracy of the estimates. Assumptions concerning the policy and regulatory framework evolutions, including norms and standards, should also be clearly expressed. Furthermore, any uncertainty in the prediction of future demand must be clearly stated and appropriately treated in risk analysis (see section 2.10). The method used for forecasting, the data source and the working hypotheses must be clearly explained and documented in order to facilitate the understanding of the consistency and realism of the forecasts. Even the information about the mathematical models used, the tools that support them and their qualification, are fundamental elements of transparency.

GOOD PRACTICES

✓ Use is made of appropriate modelling tools to forecast future demand.

✓ Where macro-economic/socio-economic data/forecasts are available from official national sources, consistent use of them is made across all projects/sectors within the country.

✓ Demand is appraised separately for all distinct groups of users/consumers relevant to the project.

✓ Effects of current or planned policy measures and economic instruments that could influence the project are taken into account for demand analysis. Also, all parallel investments potentially affecting the demand for services delivered by the project are identified, described and assessed.

COMMON MISTAKES

X The methodology and parameters used for estimation of current and future demand are not explicitly presented nor justified, or they deviate from national standards and/or official forecasts for the region/country.

X Users’ growth rates ‘automatically’ assumed throughout the entire reference period of the project are

overoptimistic. Where uncertainty exists, it is wise to assume a stabilisation of demand after the first e.g. 3-to-X years of operation.

X Insufficient or incomplete market analysis often leads to an overestimation of revenues. In particular, a full assessment of the competition in the market (projects providing similar products and/or surrogates) and quality requirements for project outputs are often neglected.

X The link between demand analysis and design capacity of the project (supply) is missing or unclear. The design capacity of the project should always refer to the year in which demand is highest.

Undertaking a project entails the simultaneous decision of not undertaking any of the other feasible options. Therefore, in order to assess the technical, economic and environmental convenience of a project, an adequate range of options should be considered for comparison.

Thus, it is recommended to undertake, as a first step, a strategic options analysis, typically carried out at pre-feasibility stage and which may require multiple criteria analysis (see box). The approach for option selection should be as follows:

• establish a list of alternative strategies to achieve the intended objectives;

• screen the identified list against some qualitative criteria, e.g. multi-criteria analysis based on a set of scores22, and identify the most suitable strategy.

- Different routes or construction timing in transport projects (roads/rails).

- Centralised vs. decentralised systems for water supply or wastewater treatment projects.

- A new gravity sewer main and a new wastewater treatment plant vs. a pumping station and pressure pipes that pump the wastewater towards an existing treatment plant, but with a capacity which has to be increased;

- Different locations for a centralised landfill in a regional waste management project.

- Retrofitting an old power plant or building a new one.

- Different peak-load arrangements for energy supply.

- Construction of underground gas storage facilities vs. new LNG terminal.

- Large hospital structures rather than a more widespread offer of health services through local clinics.

- Possible re-use of existing infrastructure (e.g. ducts, poles, sewerage networks) or possible co-deployment with other sectors (energy, transport) to reduce the cost of broadband deployment projects23 24 25 26.

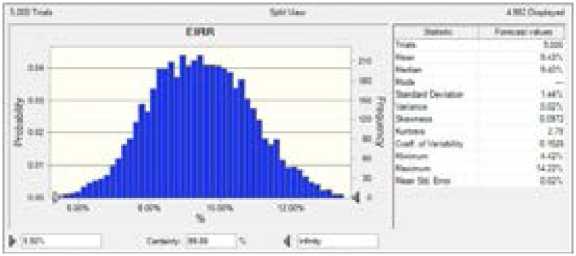

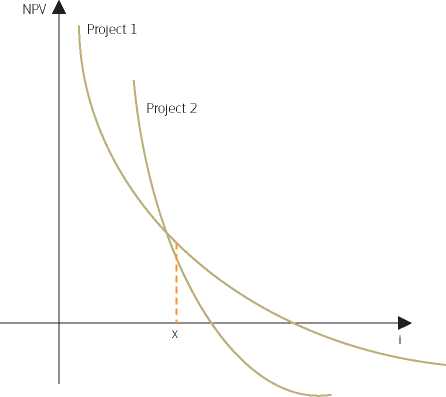

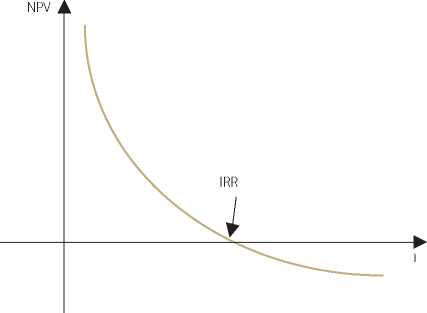

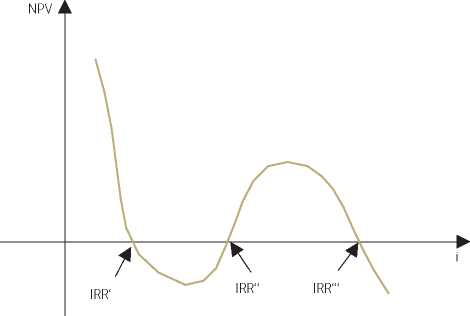

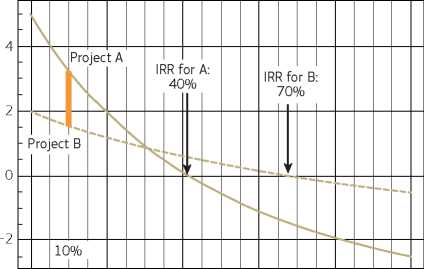

- Different procurement (classic public procurement vs. PPP) and user charging methods for large infrastructures.